When you hit a big jackpot at a casino, things move fast—and not just for you. Casino staff swiftly step in to verify your win and check your identification. They’ll likely guide you through some paperwork, and security measures kick in right away. But what exactly happens next, and how do you actually get your hands on that money? It’s not as simple or immediate as you might think.

When a player wins a significant jackpot at a casino, a standard verification process is initiated to ensure the legitimacy of the win. Casino personnel will first check the functionality of the slot machine to confirm that it operated correctly at the time of the win.

It's required for the winner to present valid identification; without this, the payout may be delayed until proper identification is provided.

For larger payouts, it's common for casinos to restrict access to the area and increase security measures, which helps maintain integrity in the gaming environment. This policy is consistently applied to all patrons to ensure equitable treatment.

After the verification is completed, casino staff will provide information regarding the next steps in the payout process. This includes any necessary documentation, such as Form W-2G, needed for tax purposes if the winnings exceed federal reporting thresholds.

This procedure ensures compliance with legal requirements while safeguarding both the casino and the winner's interests.

Casinos have established protocols for distributing winnings to ensure a secure and orderly process. For smaller wins, players typically receive their payouts in the form of cash, chips, or checks. In contrast, larger jackpots necessitate a more thorough verification process.

When a significant win occurs, casino staff will first confirm the legitimacy of the win, which includes checking for any errors in the gaming machine and verifying the identity of the winner. This step is essential to prevent fraud and to ensure compliance with gaming regulations.

For payouts exceeding a certain threshold, commonly set at $5,000, casinos usually issue checks as a security measure. Players are often presented with options for receiving their large payouts, which may include a lump sum payment or an annuity, each carrying distinct tax implications. A lump sum payment provides immediate access to the funds but may result in a higher tax burden in the year received.

Conversely, an annuity spreads the payments over time, which can help manage tax liabilities but delays access to the full amount.

After your win is verified and the payout process begins, you'll need to make a decision on how to receive your winnings. For substantial gambling winnings, such as those from a jackpot, you generally have the option of selecting either a lump sum or an annuity payment.

Choosing a lump sum allows you to receive approximately 50-60% of the total prize immediately. However, this method can lead to a higher tax liability in the year you receive the payment, as the entire amount is subject to taxation at that time.

In contrast, opting for an annuity spreads the payout over a period of time—often 30 years. This approach can help with financial management and may offer tax advantages, as the tax burden is distributed over multiple years rather than being incurred all at once.

It is also important to note that different casinos may have specific policies regarding payout options, which could influence your decision.

Therefore, it's advisable to review the terms and consult with a financial professional when considering your payout method.

Before being able to collect a significant win at a casino, it's essential to present a valid government-issued identification to verify your identity. The identification protocols implemented by casinos are uniform and apply to all players, irrespective of their origin. This standardized verification process is designed to ensure that winnings are awarded to the rightful recipient.

In addition to verifying a player's identity, casino personnel are responsible for confirming the integrity of the gaming machine involved in the win. This step is crucial to rule out any potential malfunctions or tampering that could affect the outcome of the game.

If a player is unable to provide the appropriate identification, the casino will temporarily withhold the payout until compliance with these requirements is achieved.

Once the verification process has been successfully completed, casino staff will outline the subsequent steps necessary for a secure payout. This methodical approach reinforces the integrity of casino operations and helps maintain trust in the gaming environment.

Winning at a casino comes with certain tax obligations that should be carefully considered. In the United States, all gambling winnings are subject to federal income tax and must be reported as taxable income, regardless of the amount.

For significant winnings, casinos typically issue a W-2G form, which outlines the amount won and is used for tax reporting purposes. The federal tax rate for gambling winnings is generally 24% for substantial amounts.

Additionally, state taxes may also be applicable, varying by state, which can further impact the total tax owed. Non-U.S. citizens may experience higher automatic withholding rates on their gambling winnings.

To ensure accurate reporting and compliance with tax regulations, it's advisable for winners to maintain detailed records of both winnings and losses. This documentation can be beneficial for reporting purposes and may allow winners to offset some of their taxable income.

When winning a substantial amount at an online casino, the payout process typically involves several steps and may not be immediate. Initially, players must undergo a verification process, which requires them to provide identification and proof of address to validate their accounts before any winnings can be disbursed. This step is essential for preventing fraud and ensuring compliance with regulatory requirements.

In cases of significant prizes, such as progressive jackpots, online casinos may need to coordinate with game developers to confirm the payout, which can contribute to longer processing times. Regulatory authorities mandate that players receive full payouts for these jackpots, ensuring that the total amount won is ultimately transmitted to the player.

However, it's important to note that maximum withdrawal limits imposed by the casino may require players to initiate multiple transactions to receive their complete winnings. Additionally, funds may be held until the conclusion of the verification process, potentially complicating the timeline for receiving payment.

Therefore, it's advisable for players to familiarize themselves with the specific withdrawal policies of the online casino before proceeding to cash out, as understanding these rules can help manage expectations regarding the payout timeframe.

After receiving a significant casino jackpot, it's important to approach the management of your winnings with careful consideration.

First, evaluate your payout options, which typically include a lump sum payment or an annuity. Each choice has different implications for your tax obligations, as a lump sum may result in a higher immediate tax burden compared to receiving payments over time through an annuity.

Engaging a tax professional is advisable to assist you in understanding the nuances of gambling taxes. They can provide insights on how your jackpot affects your overall income for the year, especially concerning tax brackets and potential deductions.

Keeping detailed records of your gambling activities, including winnings and losses, is critical. These records can substantiate any claims for deductions and ensure compliance with tax regulations.

Strategic financial planning at this early stage will help you manage your assets effectively and maintain financial stability in the long term. This includes considering aspects such as investment options, retirement planning, and developing a budget that aligns with your new financial reality.

Winning a substantial amount at a casino can lead to delays in accessing funds. Casinos implement strict verification processes for large jackpots, which include reviewing the performance of the gaming machine and validating the winner's identity.

Generally, if the winnings exceed $5,000, casinos often provide a check instead of cash, which can prolong the disbursement process.

Online casinos may experience extended wait times as they conduct additional software checks and adhere to withdrawal limits. For substantial winnings, such as those in the million-dollar range, players may receive payment in either a lump sum or installment payments, both of which are subject to withholding taxes.

It is important to recognize that any gambling winnings must be reported to tax authorities, and the verification and compliance procedures can further delay access to the funds.

Winning a substantial amount at a casino doesn't typically lead to a ban for the player. Casinos primarily develop policies that focus on identifying and addressing unfair player behavior rather than penalizing individuals for experiencing winning streaks.

While consistent large wins may attract increased attention from casino staff, such as monitoring gameplay or asking questions for clarification, this doesn't imply that the player will face exclusion from the premises.

Casinos benefit from having winning players, as their continued participation can contribute positively to the establishment’s revenue.

By fostering positive relationships with frequent winners, casinos incentivize ongoing play while simultaneously ensuring compliance with their fairness and integrity policies.

Thus, while vigilance is employed in monitoring player behavior, the focus remains on promoting an equitable gaming environment rather than restricting successful individuals.

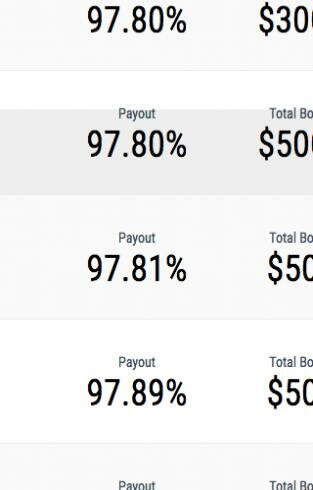

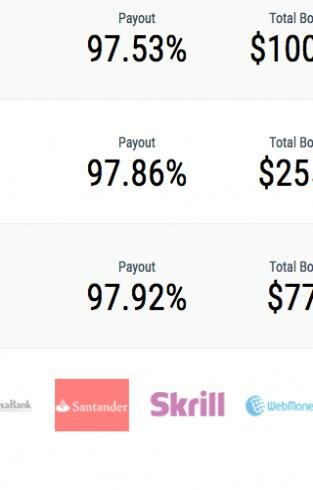

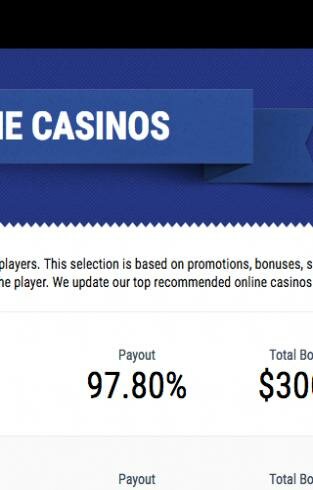

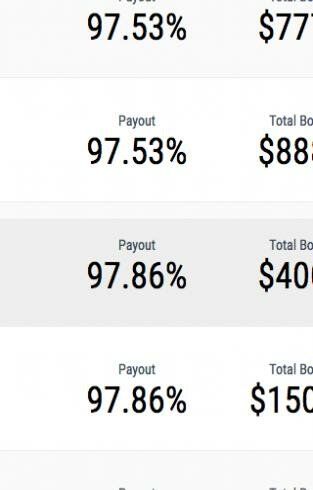

It's essential to approach online gambling with caution to avoid the risks associated with scams and fraudulent casinos. Before engaging with any online casino, verify that it's licensed by a recognized regulatory body, as legitimate casinos will make this information easily accessible for verification.

Assessing website quality is also critical; indicators of potential fraud include poor website design, absence of clear contact information, and negative user reviews available on consumer protection websites, such as the Better Business Bureau.

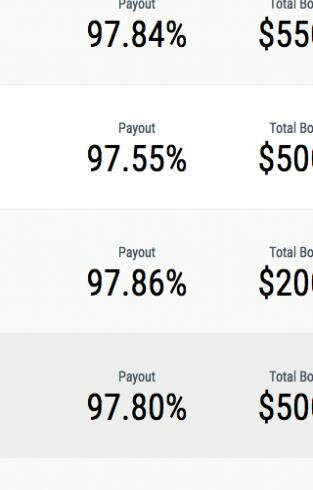

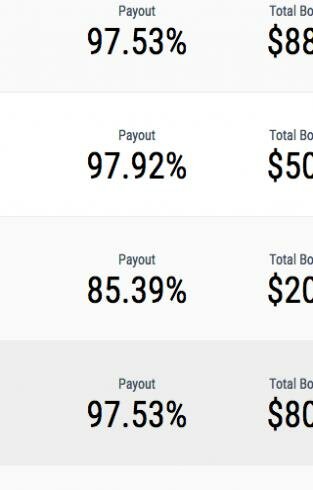

Additionally, it's advisable to examine payout percentages and rigorously read the terms and conditions, as fraudulent operations may conceal unfavorable clauses that can adversely affect players.

It's also prudent to remain skeptical of promotions that appear overly generous, as they're frequently employed to lure unsuspecting players. By maintaining a cautious approach, individuals can better safeguard their interests while engaging in online gambling.

Winning big at a casino is thrilling, but it comes with important steps you can’t skip. You’ll need to verify your identity, consider payout options, and understand your tax obligations. Be ready for possible delays as the casino checks everything. Protect yourself from scams and think about managing your new wealth wisely. Stay engaged with the staff and follow their procedures, so you can enjoy your winnings with confidence and peace of mind.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|